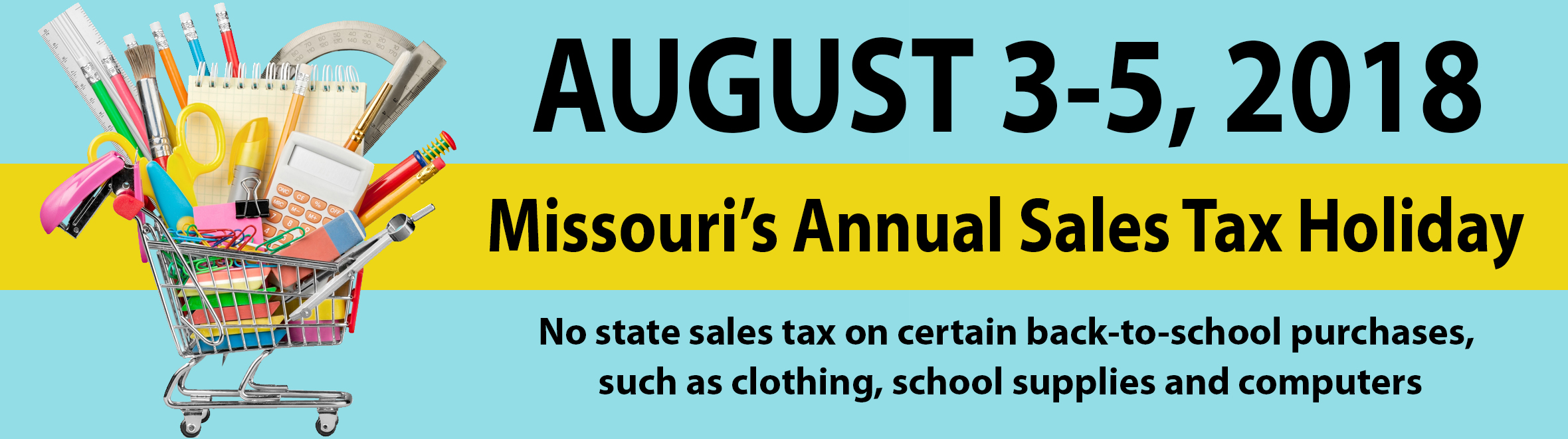

This year’s sales tax holiday, from 12:01 am, Friday, August 3 to midnight, Sunday, August 5, will offer shoppers a tax-free opportunity to purchase school supplies.

This year’s sales tax holiday, from 12:01 am, Friday, August 3 to midnight, Sunday, August 5, will offer shoppers a tax-free opportunity to purchase school supplies.

While shopping for back-to-school items, individuals are urged to take advantage of the sales tax exemption on the following:

• Clothing – any article having a taxable value of $100 or less

• School supplies – not to exceed $50 per purchase

• Computer software – taxable value of $350 or less

• Personal computers – not to exceed $1,500

• Computer peripheral devices – not to exceed $1,500

• Graphing calculators – not to exceed $150

Section 144.049, RSMo, defines items exempt during the sales tax holiday as:

“Clothing” – any article of wearing apparel, including footwear, intended to be worn on or about the human body. The term shall include, but not be limited to, cloth and other material used to make school uniforms or other school clothing. Items normally sold in pairs shall not be separated to qualify for the exemption. The term shall not include watches, watchbands, jewelry, handbags, handkerchiefs, umbrellas, scarves, ties, headbands or belt buckles.

“School supplies” – any item normally used by students in a standard classroom for educational purposes, including but not limited to, textbooks, notebooks, paper, writing instruments, crayons, art supplies, rulers, book bags, backpacks, handheld calculators, graphing calculators, chalk, maps and globes. The term shall not include watches, radios, CD players, headphones, sporting equipment, portable or desktop telephones, copiers or other office equipment, furniture or fixtures. School supplies shall also include computer software having a taxable value of $350 or less.

“Personal computers” – a laptop, desktop or tower computer system which consists of a central processing unit, random access memory, a storage drive, a display monitor and a keyboard and devices designed for use in conjunction with a personal computer, such as a disk drive, memory module, compact disk drive, motherboard, digitizer, microphone, modem, motherboard, mouse, multimedia speaker, printer, scanner, single-user hardware, single-user operating system, sound card or video card.

The tax holiday qualifies for personal-use items only. Items cannot be put on layaway and paid for later tax-free.

Shoppers do not need to be Missouri residents to purchase tax-exempt items.

Facebook Comments